Chartanalysen Square - Formations

Reversal Patterns

On this page you will find a selection of important chart patterns , which make it easier for traders to identify profitable trades!

Certain warning signs show an analyst that a trend is likely to reverse. To do this, the dominant trend channel and it should be left allows form an easily recognizable reversal pattern

Some examples of such trend changes show the following figures:

Warning: The triangles and wedges are also acting as continuation patterns!

Top Reversal Patterns

Bottom Reversal Patterns

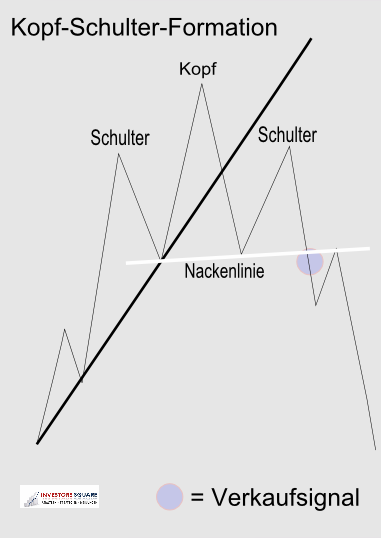

The Shoulder-Head-Shoulder (S-H-S) Formation

The Shoulder-Head-Shoulder Formation

The S-H-S formation is one of the most famous reversal patterns.

The first warning sign was the break of the uptrend, then the only course ereichte a deeper high (right shoulder) on the price level of the left shoulder.

The compound of the lows before and after the "head" neck line is called. The sell signal is given below in this line. A Kiss Back is likely, but should not go beyond the neckline also.

As a rough guide and the target price forecast, take the vertical distance of the top (head) to the neckline and projects that down!

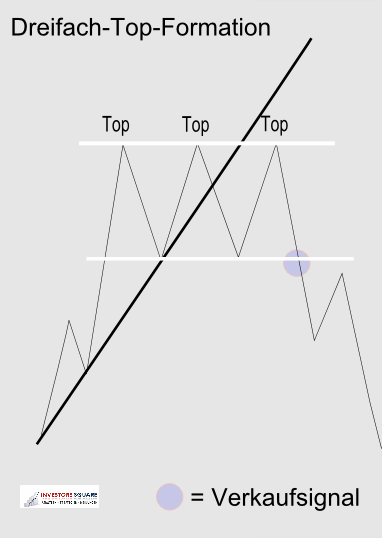

TopThe Triple Top

The Triple Top<

As with the S-H-S formation here the first warning sign was the break in the trend. In contrast to the shoulders and the head, in this formation all three peaks are at about the same Course level.

The sell signal is triggered when the support line at high volume is broken. Target also the distance between peaks and lows is projected downwards.

A Kiss Back is also possible here.

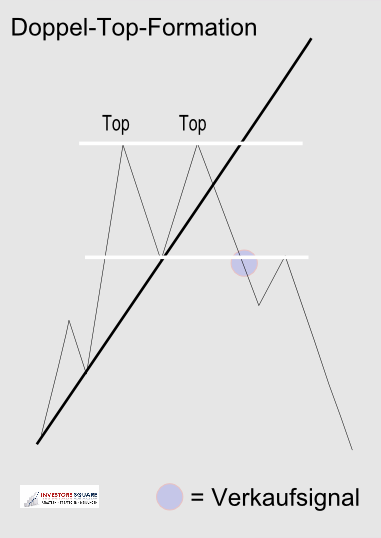

TopThe Double Top

The Double Top

The double top is almost identical to the triple top, only here arise only two peak before the sell signal is triggered.

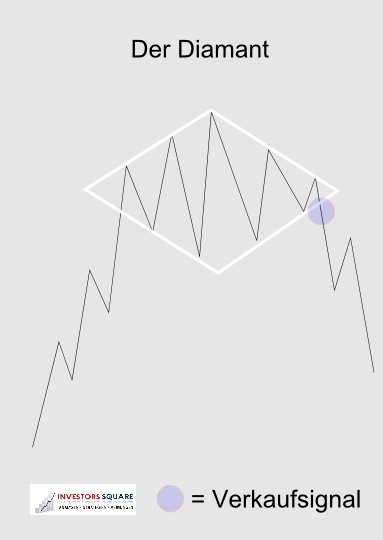

TopThe Diamond

The Diamond

The diamond is a rare top reversal pattern. The courses run at the start of Formation fanned apart and run in the second half of formation together.

Good Selltrigger arises when leaving the formation at the lower trend line.

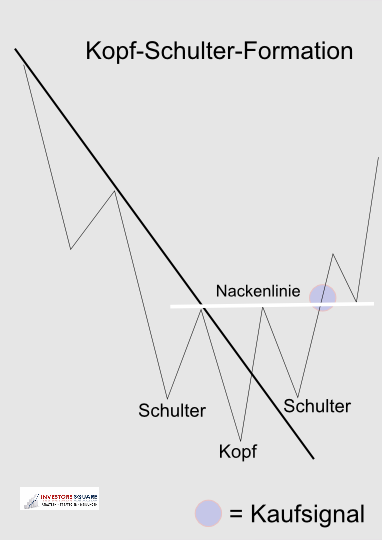

TopThe inverse Shoulder-Head-Shoulder Formation

The inverse S-H-S Formation

The inverse Shoulder-Head-Shoulder Formation occurs at the end of a downtrend. Although the head marks a new distinctive deep, but after that the downtrend broken (first warning).

An adjoining higher low (2. Shoulder) is formed at the level of from the first shoulder. A break of the neckline activated a new buy signal.

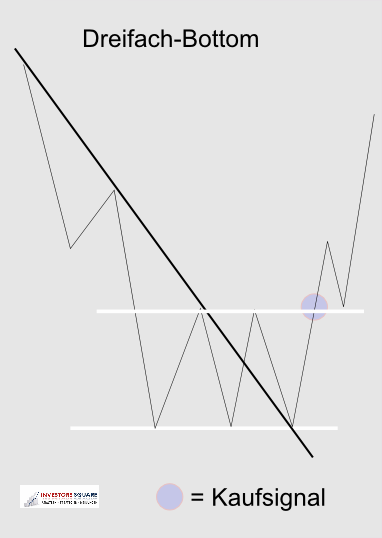

TopTriple Bottom

The Triple Bottom

The triple bottom is the counterpart to the Triple Top

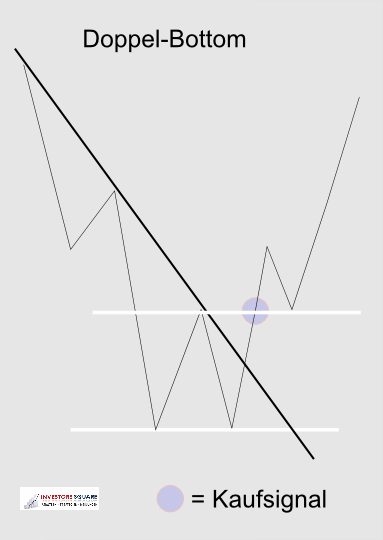

TopDouble Bottom

The Double Bottom

The Double Bottom is the equivalent to the Double Top

Top