Chartanalysen Square - Theories

The Dow-Theory

In spite of the advanced technology and the many computerized trading systems are the basics & origins any modern technical analysis more than 100 years back.

Charles Dow (06.11.1851 - 04.12.1903) was a journalist, economist, the first editor of a market letter End of the 19th Century and the "father" of the technical analysis of financial markets.

To obtain guidelines on price trends Dow published on 03 July 1884 the Dow Jones Railroad Average. This first U.S. equity index consisted of 11 joint-stock companies (9 rail and 2 industrial companies).

Thus, Dow was able to analyze the share prices and the economic development even better, 1896, the pure industry index "Dow Jones Industrial Average", which is still regarded as one of the key indices in the global markets. The opening price of the index was 26 1896 May at 40.94 points.

The findings of his studies, he published regularly in the Wall Street Journal. After his death in 1902 books were published with the abstract of his theory, including "The ABC of Stock Speculations "by SA Nelson (1903)," The Stock Market Barometer "by Peter Hamilton (1922) and" Dow Theory "by Robert Rhea.

Key points of the Dow Theory

1. The indices reflect all relevant information

The courses process new information as soon as they are available. So if a news published will be changed at the same time the price of the stock price to reflect this news.

This point is consistent with the principles of the Dow theory of efficient markets.

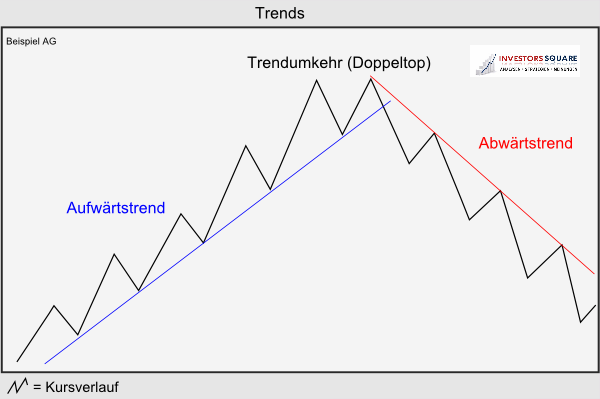

2. Definition of trends by Dow

The analyzes of Dow implied a first definition of the trend. Even this has not changed to this day and recognize that a trend is therefore still a prerequisite for profitable trades.

Even 100 years ago, Charles Dow characterize an upsurge in that these rising Highs and rising lows marked.

Accordingly reversed the downward trend of falling highs and lows falling.

3. The prices of the indices are divided into three trends

- 1. The "main movement", primary trend or major trend is at least a year to several years. He is either bullish or bearish.

- 2. The "medium swing", secondary trend or intermidiate reaction extends over 10 days to three months and will move between the previous 33% to 66%.

- 3. The "short swing" or minor movement varies from hours to a month or more.

The three types of trend may occur in principle simultaneously. For example, a minor movement in a secondary bullish trend in the main bearish movement.

As an indication of the temporal information of the individual trends must take into account that only a hundred years ago very low conversions were traded. Nowadays, every minute and second of millions of transactions performed, so the markets are always "fast moving" become!

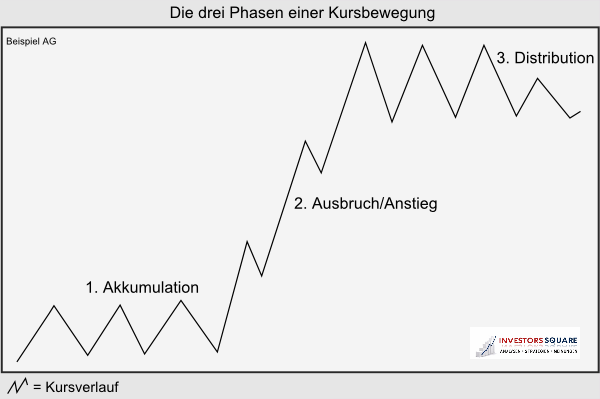

4. The three phases of a price movement

The Dow Theory asserts that every major trend can be divided into three different phases.

1. The accumulation phase: This phase is characterized in that investors buy into a lateral sliding zone and sell stocks. The stock price changed so little.

2. The eruption phase: If the lateral sliding zone is left, this is done for technical reasons, very impulsive and leads to a clear upward or downward trend, of which especially the technically oriented investors participate.

3. The Distribution Phase: When it comes to excessive speculation investors are smart (and later others) close out their positions, and it is again on a different level to a sideways movement.

5. The volume must confirm the trend

Dow was the belief that the volume must confirm the price trend. If at low prices Revenue sources, this may change for many reasons. Dow was therefore of the opinion that only the high volume reflects "true" market opinion.

So if many market participants are active in a price move, this can be interpreted to Thurs so that the Movement is deliberate and will therefore continue.

For him, high turnover was a sign that a sustained trend develops.

In general, rising sales when the prices move in the direction of this primary trend (Volume goes with the trend). In the bull market should increase revenues when prices rise and fall, though the prices fall. In a downtrend, the opposite is true. With falling prices should increase sales and at a "bear market rally" sink.

6. The principle of the confirmation

To Dow's times the industrial strength of the United States grew rapidly. The producers with their factories were far above distributed the land and therefore had to transport their goods to the markets. This usually happened with the Web. For Dow has established itself so only a bull market in Industrial Index if this index by the Railroad was confirmed. The two indices should therefore move in the same direction and thus confirm each other. Divergences occur on, it indicates that changes in the air.

7. A trend exists until there are definite signs that he has been reversed

Dow was the belief that trends continue to exist even when it comes to short-term counter-movements. only if there are clear and significant signs of a turnaround, this is considered as the beginning of a new trend.