Chartanalysen Square - Indicators

Moving Average Convergence/Divergence (MACD)

The Moving Average Convergence / Divergence (MACD) is somewhat of a hybrid of moving averages and an oscillator. It was developed by Gerald Appel and is considered by many technical analysis as a very reliable indicator. The combination of the image of the current dynamic movement with Kauf-/Verkaufssignalen of intersecting averages makes it a popular tool in technical analysis.

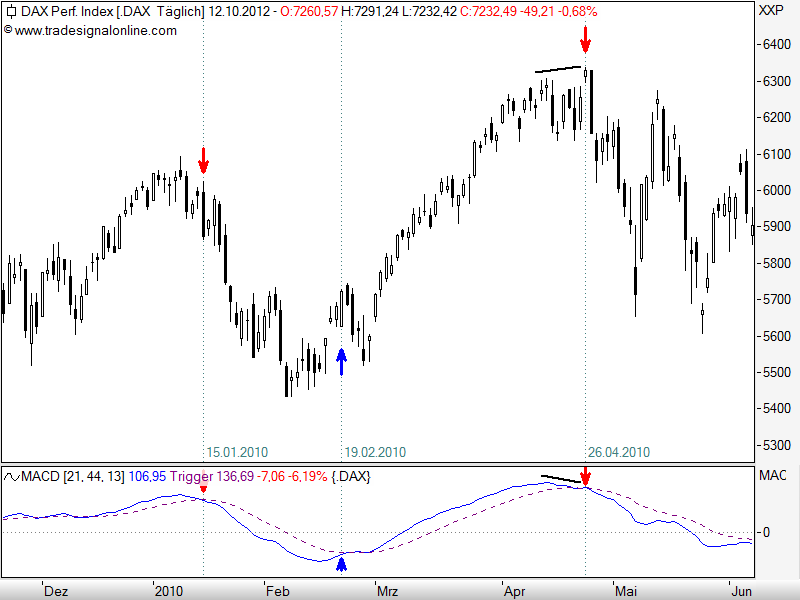

The following chart shows the daily chart of the Dow with an underlying MACD indicator. The faster, blue "MACD line" is in our case filed with the values 21 and 44. That is, they form the difference between two Moving Averages of (closing prices of the last 21 or 44 days).

The dashed line is a smoothed-period average of the MACD line. We form this signal line with a size 13 period from. Thus we have also integrated the Fibonacci number series.

Interpretation of the MACD course

- 1. There have trained three Buy-/Sellsignals (intersection of lines)

- 2. We see a warning ahead of the correction before 26.04. in the form of a divergence