Chartanalysen Square - Indicators

Commodity-Channel-Index (CCI)

The Commodity Channel Index (CCI) as part of the RSI to the "Oscillator-family" and hurl principle between the extreme ranges of < -100 und > 100!

The published in 1980 by Donald R. Lampert indicator compares the current price with a moving average. He then normalizes oscillators values by a divisor on the Standard deviation is based.

Was published by the CCI Welles Wilder, Jr. in his book New Concepts in Technical Trading System (1978).

The stored equation is:

M - MCCI = ––––––––––––––

0.15 x 0.15 x D

H + T + C

M = –––––––––––––

3

M= GD20 (M)

D= GD20 (Abs(M-M))

C: closing

H: highest price

T: lowest price

GD20: Arithmetic moving average (20 Tage)

Similar to the typical RSI oscillators for vibration amplitudes can in principle be evaluated in three ways.

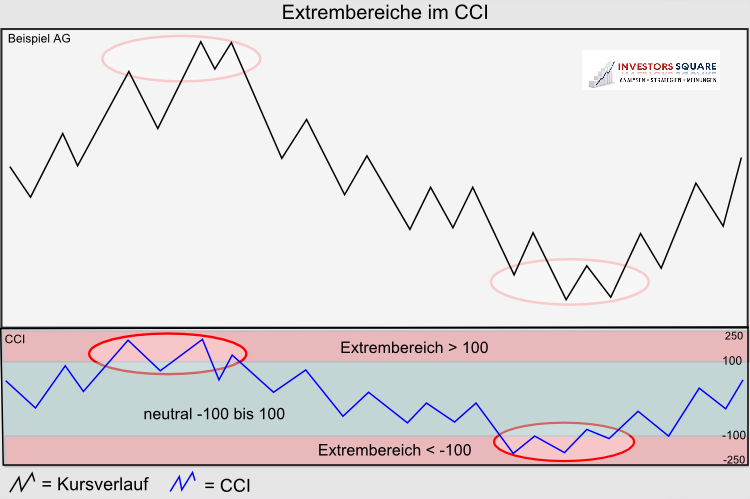

1. Extreme ranges as input and exits

Reaches the one of the two extreme regions CCI (>100/<-100), this information can be used to the existing To close positions or to open a new position. It is important that other indicators, Trends & resistances / supports will be considered!

An example: Extreme Areas

In the picture is shown as an example, that prices tend to "reduce" extreme values of the CCI. therefore, Price declines likely if the CCI trading above 100 and rising prices are expected in principle, when the CCI falls below -100.

The practice often shows that it is precisely the CCI "persist" for some time in the extreme ranges can, while the prices will go up further /, therefore should a new position opened at the extreme left portion be.

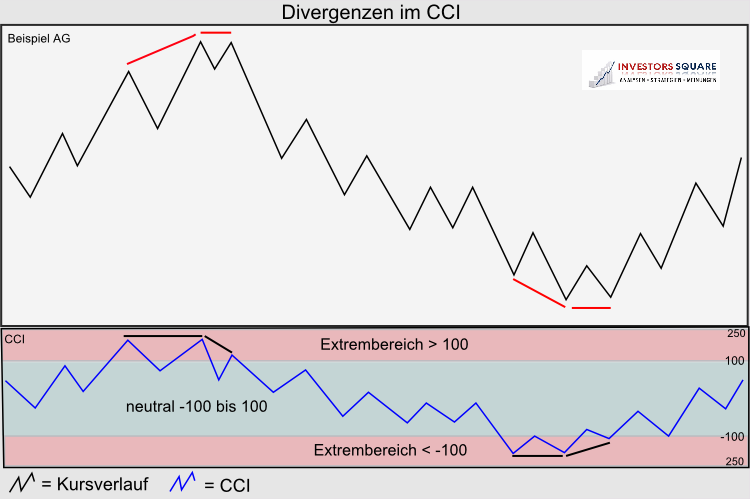

2. Divergences in the CCI

As divergences (contrasts) are not coincident developments between price and the indicator designated. If these divergences on at the extremes, the latest market trends not of the Indicator support! Thus, they are a good warning signal.

An example: Divergences

In the picture you can see clear differences in the extreme ranges. While in the left section, the courses continue rise and new highs are formed of CCI stagnates at a certain level and in the subsequent Double top in the chart is the CCI already clear.

In the right pane similar divergences in the oversold region are shown.

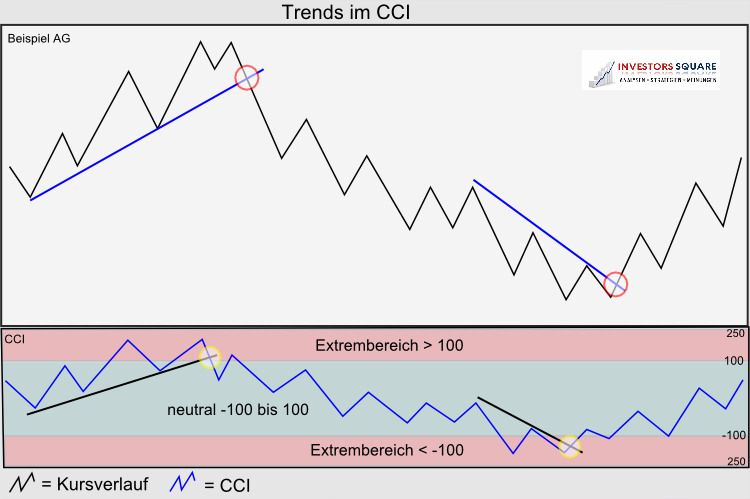

3. Trendlines in the CCI

In addition to extreme conditions and divergences are also normal trend lines and the analysis of certain Widerstands-/Unterstützungsbereiche as a signal generator. As in the normal charts have shown that the CCI and can so certain developments "predict".

An example: Trends in CCI

In the search for profitable trading signals, the analyst should also draw trend lines in the CCI sector, a possible trend reversal early on. In the picture you can see, such as the uptrend line in the CCI is broken earlier than that of the course!

Generally should be considered not to open new positions solely on the basis of the indicators presented here!

It is important that this is done only in the direction of the overall trends and also always

a Stop-Loss Info:

Stop-loss order is an order

(usually for shares or derivatives) that is run, and the current price reaches a predetermined value.

The aim of this type of order is to limit losses and gains useful safeguard. order hedged.